Periods of high volatility have forever been part of investing. But even seasoned investors might feel tempted to retreat to “safe” assets like cash during these times.

While this approach may help you sleep better at night, it’s unlikely to be good for your financial well-being.

Here’s why focusing on the long-term is crucial during periods of high volatility for shares and other investments.

The pitfalls of market timing

When markets are falling and news headlines are bleak, it might seem like a good idea to sell and wait for conditions to improve.

In reality, it’s not that easy.

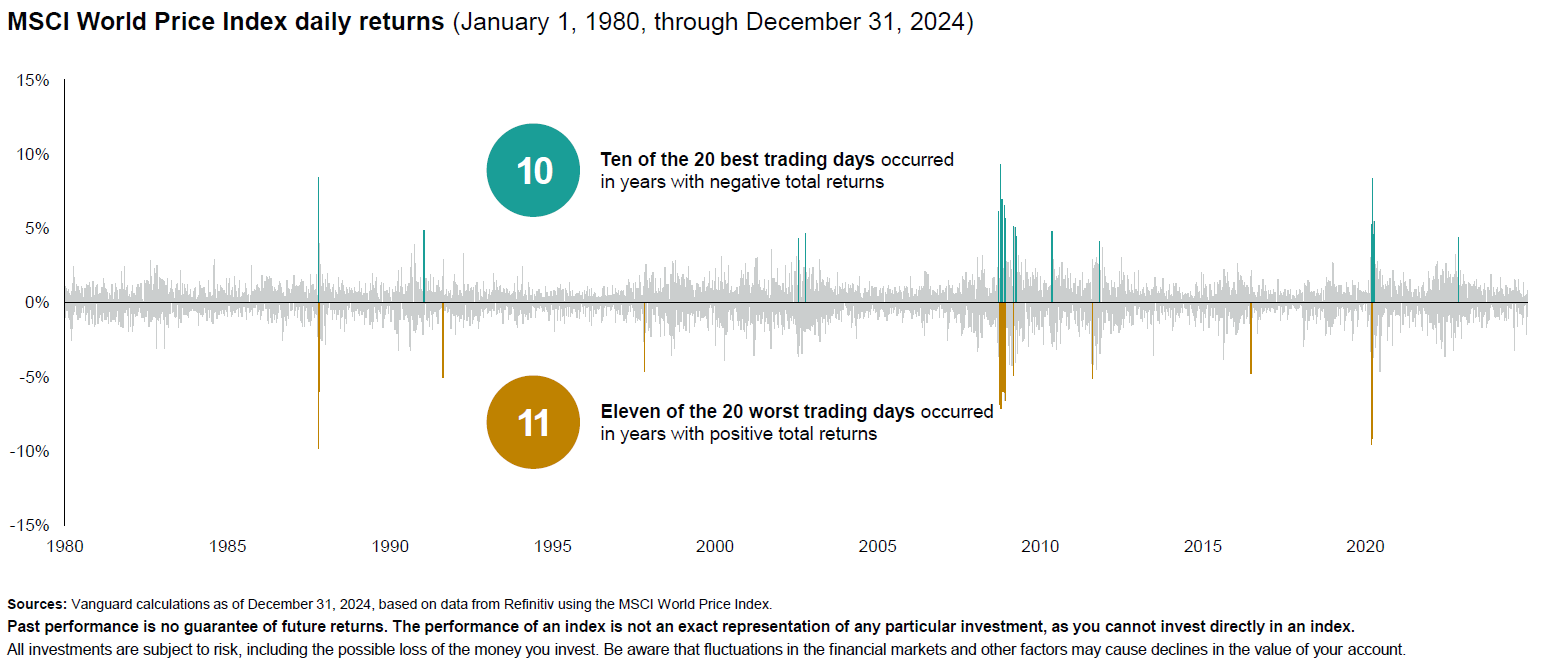

Research has shown the best and worst trading days tend to occur within days of each other, often during periods of heightened market uncertainty and distress.

Ten of the 20 best trading days as measured by the MSCI World Price Index, a leading global stock market index, from January 1, 1980, through December 31, 2024, occurred during years of negative total returns.

Meanwhile, 11 of the 20 worst trading days occurred in years with positive total returns.

It goes to show how difficult it is to successfully time the market.

Trying to time the market is futile: The best and worst trading days happen close together

When investors try to “wait out” a downturn, they run the risk of missing out on strong performance, which can seriously hamper their long-term results.

Why staying the course matters

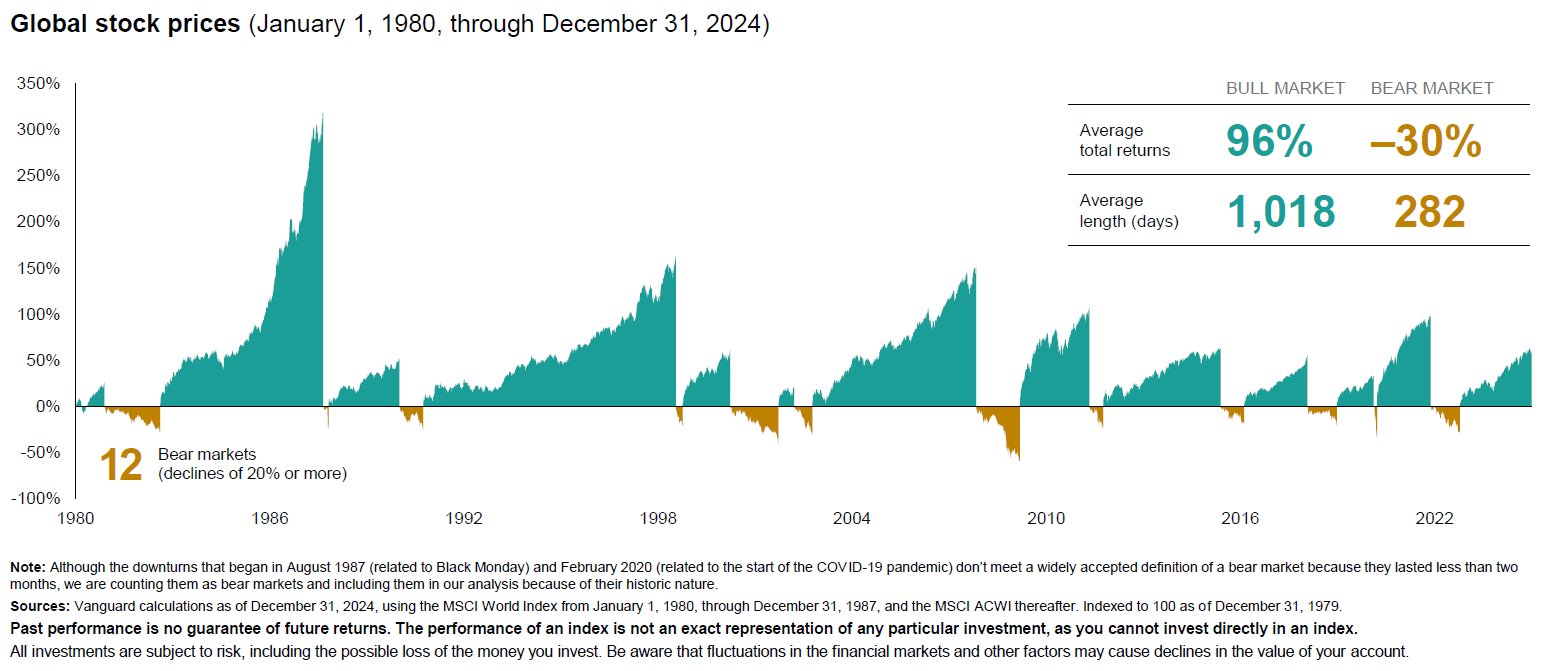

Since 1972, there have been 13 bear markets — declines of 20% or more — in global equities.

While that might sound scary, it’s important to put this in context. On average, bear markets have lasted a much shorter time than bull markets, where stocks appreciate.

From January 1, 1980, through December 31, 2024, the average length of a bull market in global equities has been nearly four times that of a bear market.

Over that period, Vanguard’s research shows average total returns for bull markets in global equities were 96% over an average of 1,018 days.

Meanwhile, the average total returns for bear markets were -30% over an average length of 282 days.

Bear markets are challenging, but bull markets have been longer and stronger

That’s one reason for sticking to a well-thought-out investment plan: losses from a bear market have typically given way to longer and stronger gains.

The risks of moving to cash

One problem with moving to cash during a panic or downturn is that you also have to pick the right time to get back into the market.

On top of that, selling assets that have appreciated in value to raise cash can have significant tax consequences. For example, you may be liable to pay capital gains tax on any profits.

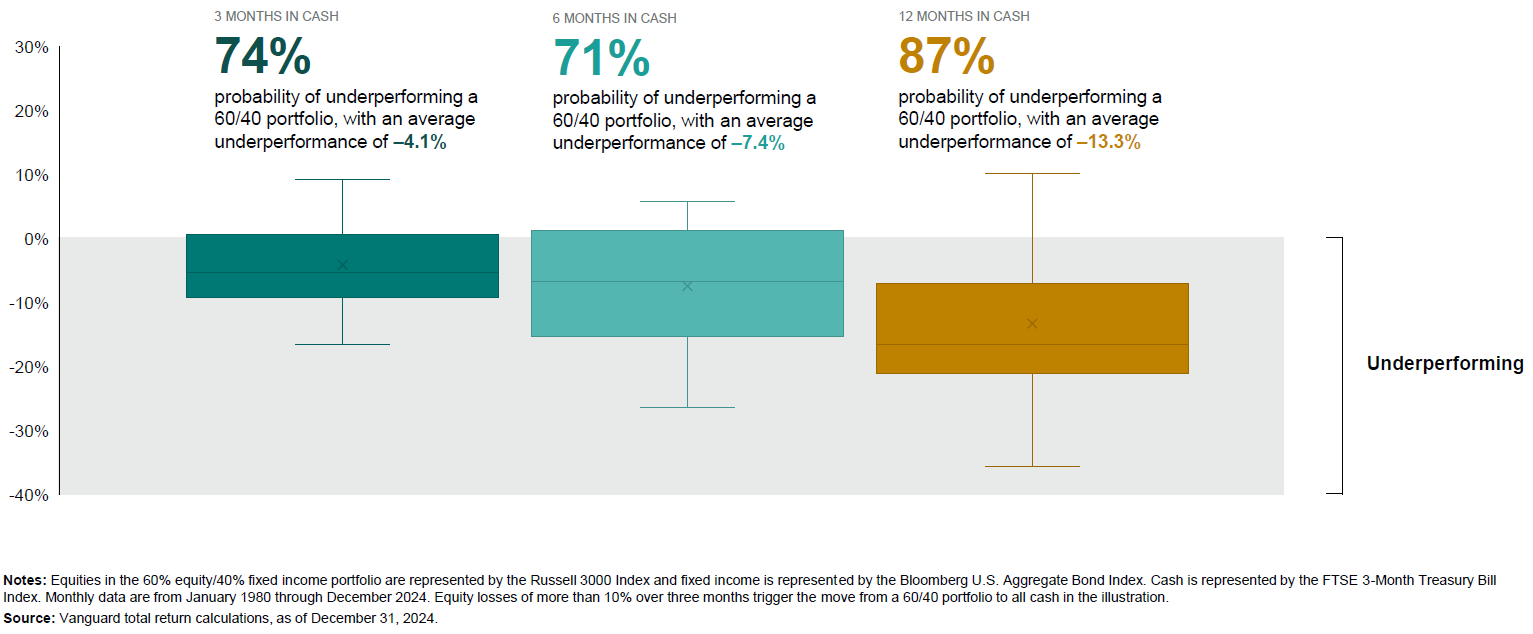

The research looked at how US investors would fare if they moved a portfolio of 60% US equities (as represented by the Russell 3000 index) and 40% US fixed income (as represented by the Bloomberg US Aggregate Bond Index) to cash (as represented by the FTSE 3-Month Treasury Bill Index).

Researchers found that investors have a 74% probability of underperforming the market with an average underperformance of 4.1% when they have moved their portfolios solely into cash for three months after a severe market event.

Moving to cash in a panic rarely pays off

Portfolio underperformance was worse for those who converted their balanced portfolios to cash and held it for longer periods of time.

Converting the portfolio to cash led to a 71% probability of underperformance over a six-month period with an average underperformance of 7.4%.

When investors converted their 60/40 portfolio to cash and held it for 12 months, they had an 87% probability of underperforming with an average underperformance of 13.3%.

Put simply, US investors who converted their 60/40 portfolios to cash in times of market stress underperformed the market most of the time.

It’s further evidence of the importance of remaining invested in a balanced, diversified portfolio and not overreacting to the latest market and economic headlines.

Reach out to us if you have any questions regarding the recent market fluctuations and how they impact your investment portfolio.

Source: Vanguard March 2025

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2022 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.